How much social insurance contribution should individual entrepreneurs pay in 2025?

How much social insurance contribution should individual entrepreneurs pay in 2025?

With the decree of the President of the Republic of Azerbaijan dated December 23, 2024, on continuing the measures to improve the social welfare of the population, the minimum monthly salary has been set at 400 manat as of January 1, 2025. This also increases the social insurance contributions of individual entrepreneurs. The new calculations are explained by expert Nüsrət Xəlilov:

According to Article 14 of the "Social Insurance Law," individual entrepreneurs who engage in entrepreneurial activities without creating a legal entity must pay social insurance contributions based on a certain percentage of the minimum monthly salary. Therefore, with the increase in the minimum monthly salary, the social insurance payments of individual entrepreneurs also rise.

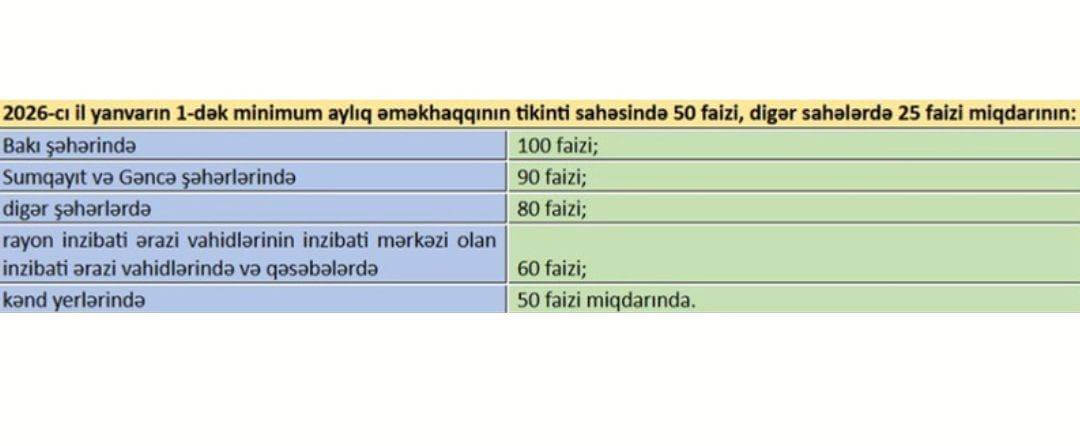

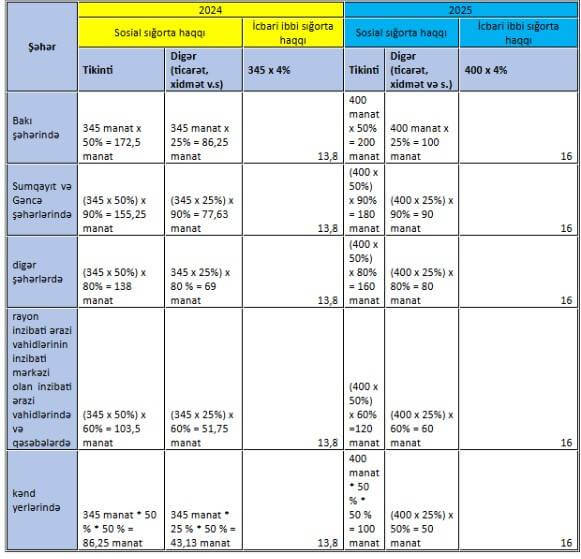

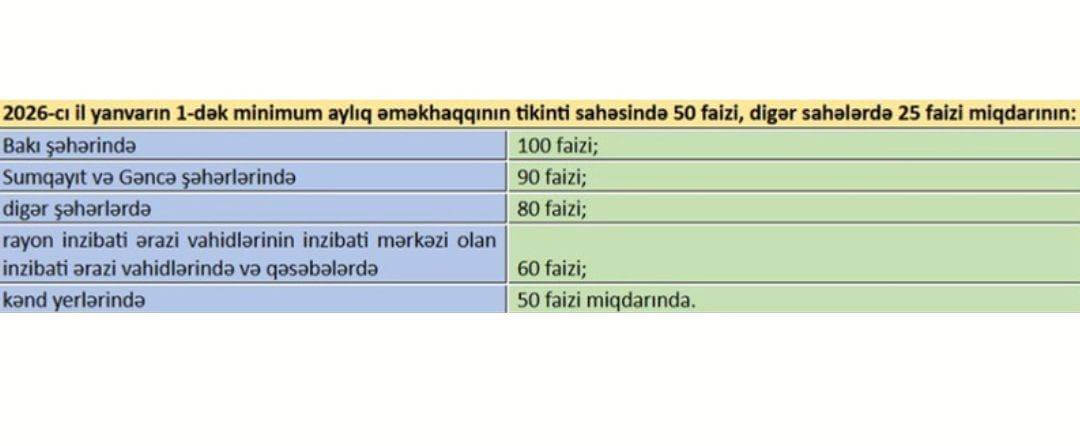

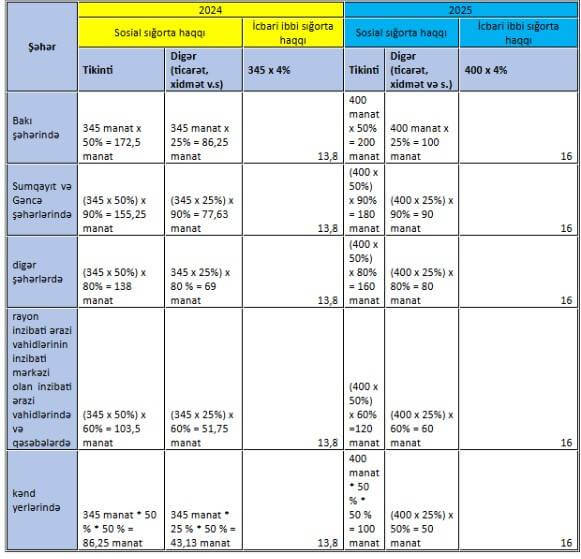

According to Article 14.5.1 of the law, except for Article 14.5.7, social insurance contributions for entrepreneurial activities will be paid at 50% of the minimum monthly salary in the construction sector and 25% in other sectors until January 1, 2026. The obligations of these entrepreneurs differ by region as follows:

Additionally, as stated in Article 15-2.2.2 of the "Medical Insurance Law," in accordance with the Tax Code of the Republic of Azerbaijan, except in cases where entrepreneurial activities or other taxable operations are temporarily suspended, individuals registered as taxpayers (individual entrepreneurs, private notaries, members of the Bar Association, mediators) act as insured persons. According to Article 15-10 of the same law, individual entrepreneurs are required to pay mandatory health insurance contributions equal to 4% of the minimum monthly salary.

With the decree of the President of the Republic of Azerbaijan dated December 23, 2024, on continuing the measures to improve the social welfare of the population, the minimum monthly salary has been set at 400 manat as of January 1, 2025. This also increases the social insurance contributions of individual entrepreneurs. The new calculations are explained by expert Nüsrət Xəlilov:

According to Article 14 of the "Social Insurance Law," individual entrepreneurs who engage in entrepreneurial activities without creating a legal entity must pay social insurance contributions based on a certain percentage of the minimum monthly salary. Therefore, with the increase in the minimum monthly salary, the social insurance payments of individual entrepreneurs also rise.

According to Article 14.5.1 of the law, except for Article 14.5.7, social insurance contributions for entrepreneurial activities will be paid at 50% of the minimum monthly salary in the construction sector and 25% in other sectors until January 1, 2026. The obligations of these entrepreneurs differ by region as follows:

Additionally, as stated in Article 15-2.2.2 of the "Medical Insurance Law," in accordance with the Tax Code of the Republic of Azerbaijan, except in cases where entrepreneurial activities or other taxable operations are temporarily suspended, individuals registered as taxpayers (individual entrepreneurs, private notaries, members of the Bar Association, mediators) act as insured persons. According to Article 15-10 of the same law, individual entrepreneurs are required to pay mandatory health insurance contributions equal to 4% of the minimum monthly salary.